michigan gas tax increase history

Repealed 1947 PA 319. Increased Gasoline Tax rate to 19 cents per gallon.

And Michigan with a gas-tax diversion rate of 339 is ranked with New Jersey as the third highest GTDR in the nation.

. The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The current federal motor fuel tax rates are.

Didnt gas taxes just go up. Is A Michigan Gas Tax Increase Inevitable. The 3 sales tax was on retail sales of tangible goods.

Liquefied Natural Gas LNG 0243 per gallon. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon. 1 Among the findings of this analysis.

Most jet fuel that is used in commercial transportation is 044gallon. The same three taxes are included in the retail price on. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

1 2017 as a result of the 2015 legislation. Both taxes will automatic increase with inflation in. Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev.

Alternative Fuel which includes LPG 263 per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Thirteen states have gone two decades or more without a gas tax increase.

This may well bring the annual increase close to. 10 states to have gone two decades or more without a gas tax increase. Michigan drivers have already absorbed an increase 73 percent that big since Gov.

Heres what MDOT says on the issue. Although the sales tax is not imposed upon the Michigan gasoline tax. For fuel purchased January 1 2017 and through December 31 2021.

36 states have raised or reformed gas taxes since 2010. Federal excise tax rates on various motor fuel products are as follows. Gas and Diesel Tax rates are rate local sales tax varies by county and city charged in PPG Other Taxes include a 075 cpg UST gasoline and diesel Hawaii.

Michigan enacted its first ever sales tax through Public Act 167 in 1933. Michigan fuel taxes last increased on Jan. The FAQs on this page are effective January 1 2022.

Inflation Factor Value of Increase Percentage. The 25 billion plan would increase the 26-cent fuel tax by 45 cents between this October and October 2020 and guarantee that the additional revenue is targeted to. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. The michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

If the retail price. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. Nineteen states have waited a decade or more since last increasing their gas tax rates.

Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon. Map shows gas tax increases in effect as of March 1 2021. Increased Gas Tax rate to 45 cents per gallon.

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. And the states gas tax as a share of the total. 10172019 105048 AM.

The current state gas tax is 263 cents per gallon. Starting January 1 2017 gas taxes will increase 73 cents and. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

Gasoline 263 per gallon. Michigans 6 sales tax levied on gasoline is not spent. It will have a 53 increase due.

The 187 cents per gallon state gas tax and the 184 cents per. Despite Recent Price Increase Gas Prices 1980 - May 2000 Figure 1 GASOLINE PRICES AND TAXES IN MICHIGAN by David Zin Economist. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

The Michigan House voted 63-39 mostly along party lines to approve House Bill 5570 which would suspend the 272-cent state gas and diesel fuel prices for six months from April 1 to Sept. In Michigan three taxes are included in the retail price of gasoline. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

Gas taxes Created Date. Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan. The increase is capped at 5 even if actual inflation is higher.

0183 per gallon. Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. Since 2013 33 states and the district of columbia have enacted legislation to increase gas taxes.

Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax by 73 cents and 113 cents to 263 cents starting in 2017. In 1960 voters approved an increase of the 3 sales tax to 4. Topics of Legislative Interest MayJune 2000 Price Before Taxes 762 1524 Federal Gas Tax 92 0184.

The tax on regular. Diesel Fuel 263 per gallon. Gretchen Whitmer made her controversial gas tax proposal earlier.

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

.png)

Map State Gasoline Tax Rates Tax Foundation

1966 Corvette Window Sticker 5 308 90 425 Hp Google Photos Car Advertising Window Stickers Corvette

Motor Fuel Taxes Urban Institute

Joe S Bike Ride Across America Day 19 Casper Wy Casper Wyoming Wyoming Travel Wyoming Vacation

Most States Have Raised Gas Taxes In Recent Years Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

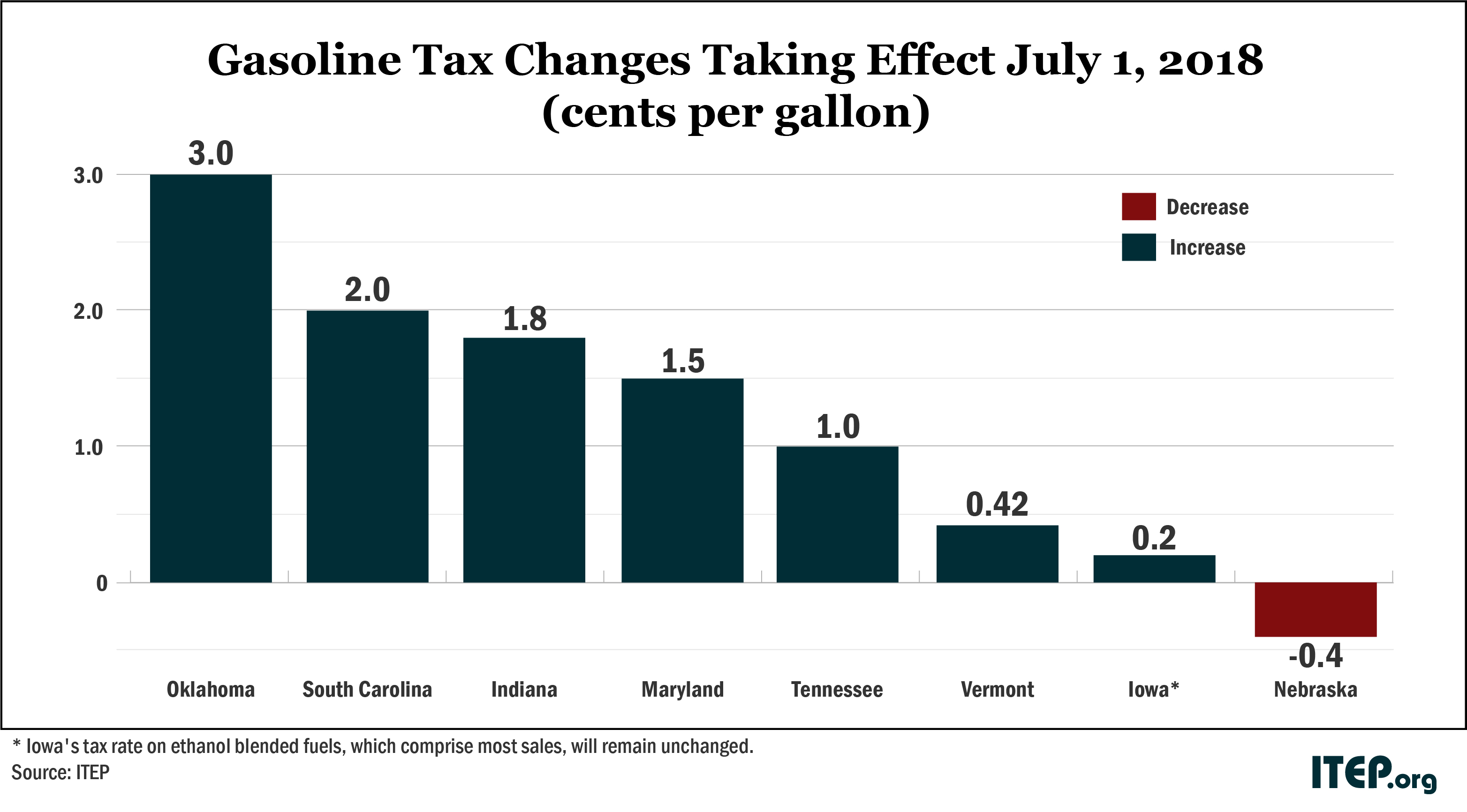

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

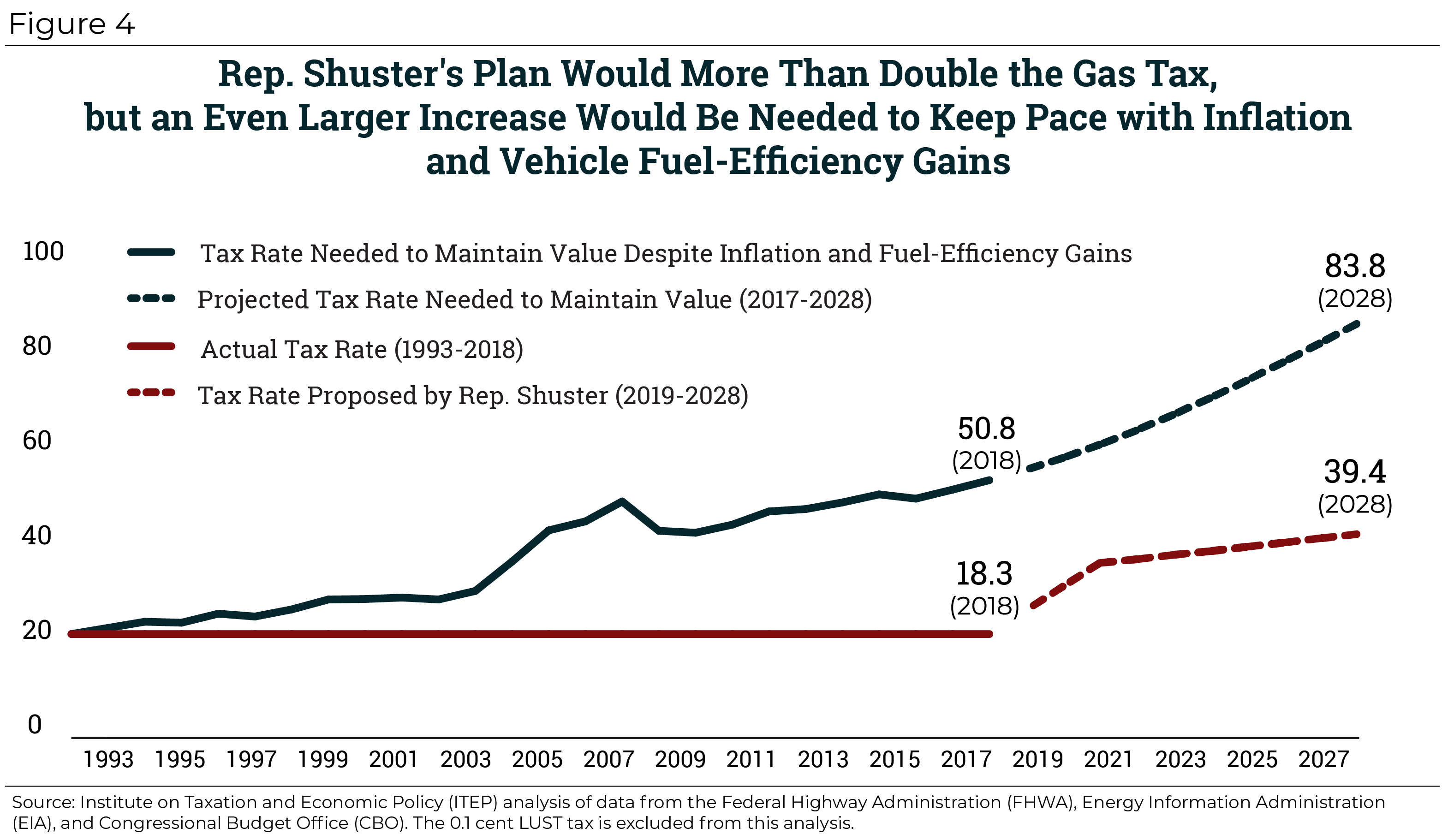

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Michigan Gas Tax Going Up January 1 2022

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

War On Cars Visclosky Consultant Says Hidden Metric Is What 5b Transformation Plan Is Really About How To Plan Sayings War

Elapsed Time Practice What Time Is It In Time Zone Map Time Zones Map